WatchGecko meets a leading specialist watch insurance broker for insider tips on how to insure your watch collection. Read more...

You have got luxury watch insurance, haven’t you?

You’ve just bought a ‘Paul Newman’ Rolex Daytona from southern Europe and need to get it to the UK. So you send your 19-year-old, all-expenses-paid, to collect the €300,000 watch. Two days later, junior’s home and the Daytona has pride of place in your collection. The venture always had its risks. But the watch had been appraised, its provenance confirmed and specialist watch insurance arranged before the trip – just in case…

Exotic though the subject matter is, this real-life example and the principles of having good insurance are relevant to luxury and affordable watch collectors. With many WatchGecko customers owning super-luxury watches as well as ours, or putting our straps on their watches, we decided to investigate. Al Hidden met Russell Jones-Walker, business development manager at Lumley Insurance, to get some insider watch insurance tips.

Regular valuations are essential

Get watches valued regularly so you know their value and can arrange sufficient cover. Watch values change; usually upward. And market variations can mean instant under insurance if cover doesn’t keep up. Just look at the 10% increase in Rolex values immediately after the UK’s 2016 Brexit referendum – and imagine being underinsured and having to make a lost Rolex insurance claim the next day.

Jones-Walker recommends getting watches professionally valued at least every three years. ‘Specialists typically charge £150–200 per hour to visit you, and typically value and inventorise three to 10 watches an hour, depending on the watches. The benefits are considerable, not least because professional valuation gives automatic proof of value, provenance and ownership without further documentation if you claim. ‘Furthermore,’ he explains, ‘if you claim and your collection was valued by a National Association of Jewellers (NAJ) member within the last three to five years, there’s another benefit: in this case, many insurers provide automatic uplift in cover to 150% of the insured value to protect against market changes.’

Clasps and straps matter

With many of our straps often gracing luxury watches such as Rolex Subs and Blancpain’s 50 Fathoms, this caught our attention. Russell Jones-Walker: ‘Whether it’s the ex-factory bracelet or an aftermarket leather band, straps and clasps are checked thoroughly during valuations. Watch insurers are interested because strap condition, whether it’s Rolex’s Oyster bracelet, your handmade Italian leather straps, or basic fabrics, helps prevent damage or loss. With time, leather, metal and other bracelet and clasp materials wear or get damaged. Rolex insurance specialists like to know that what secures your GMT Master II to your wrist is in good condition.’

Reassuringly for anyone whose TAG Heuer Carrera or 1950s Favre-Leuba Seabird is on aftermarket leather, insurers don’t mind – as long as the strap is in good condition. By the way, the value of expensive manufacturer-signed rubber, mesh and leather straps for a luxury watch like a Breitling Superocean Héritage can soon approach the watch’s value.

Wear your watches with pride

As part of your lifestyle, watches are meant to be worn and enjoyed. Insurers actually like you to wear your watches, instead of keeping them squirrelled away. Underwriters like watch collections to be spread between wrists, displays and safes so they aren’t together if the worst happens. ‘If watch collections are dispersed,’ says Jones-Walker, ‘premiums are often less, and security requirements more relaxed, than if everything’s kept together.'

This applies to affordable watches as well as Vacheron Constantin and Greubel Forseys. Good watch insurance is about matching the cover to your lifestyle, not forcing you to change your lifestyle and wearing habits. Take keen gardeners for instance;’ he adds. ‘one client insisted on wearing his Patek Philippe while gardening. Why not, when watches are for wearing? Eventually, perhaps inevitably, the watch was damaged, but it was insured, so everything was fine.’

Understand your contents insurance

Off-the-shelf cover is fine if your collection is just a few Seikos and a Montblanc Timewalker. Depending on your specified valuables limit, you’ll need to specify the luxury watch. But at this level, the watches’ value is low compared with your total household contents. For many people, keeping abreast of watch values and specifying them as appropriate, means standard insurance suffices. ‘Don’t specify watches valued considerably less than your insurer’s specified-item threshold, cautions Jones-Walker. ‘If you do, and claim, and the watch’s value has risen, you may only get your specified value rather than the higher figure.‘

The Vintage Watch Company located in Burlington Arcade.

However, once a collection includes several ‘entry-level’ luxury watches, specialist insurers can often arrange better cover and better value.’ Jones-Walker again: ‘It’s worth noting that brokers like us normally only do this if the watches are insured as part of a household insurance policy. This is because the premium for the watches will be lower than if insured separately. The reason for this is that other lower risk property (e.g. buildings) mitigates higher risks, such as jewellery and watches. Some providers, including jewellers and online insurers, offer standalone jewellery and watch insurance – but you won’t get the traditional broker’s advice, cover is generally more restrictive and the lifestyle element can get lost.’

Making sure you understand how your cover works and getting regular valuations for insurance purposes is vital. And so is regular servicing…

Watch servicing matters

We all know someone with a 20-year-old Seiko that’s never been serviced, yet runs perfectly. But for most watches, whether it’s your new Rolex Sky-Dweller, vintage IWC Da Vinci Perpetual Calendar, or that exquisite 1955 Breitling Navitimer Pre 806 V72, servicing matters.

All watches need servicing at some point, whether to maintain manufacturers’ warranties or look after watch mechanisms crafted before the days of 10-year service intervals. For anything vintage or exotic (and Rolex in particular), regular servicing is essential to complement your insurance.

As Jones-Walker says, this will reduce the likelihood of claim settlements being reduced or declined: ‘A client swam wearing a £20k rose gold Rolex Oyster Perpetual Day-Date. Unfortunately, the 100-m rated watch hadn’t been serviced to schedule, which would have revealed the worn crystal seal. Unfortunately, water got in and the repairs cost over £11k. Because it was accidental damage, the insurer paid, but not for the crystal and seal. Even the best Rolex insurance can’t save you completely if you miss a service!’

Of course, servicing is about more than just insurance. Imagine a bracelet failing through lack of servicing and losing your watch. Even if it’s insured, there’s still the sentimental value. You can buy another Daytona; but not the one you got for your twenty-first birthday.

For many of us, a Daytona or a Lange 1 Tourbillon Perpetual Calendar is a far-off dream. So what about us mere mortals who, for the time being, enjoy the more affordable end of the watch spectrum?

Even ‘affordable watches’ need insurance

If your only watch is a Seiko SKX007 ‘beater’, your home contents policy should be sufficient. And even as you add more affordable watches, standard policies should be fine. The thing is, watches are addictive and collections grow. Suddenly, two watches valued under £1000 has become a growing five-figure collection. It only takes buying your first Rolex, or a Mad Men era Universal Genève Polerouter, to change your insurance profile and increase the importance of specialised advice. Even if your watches can still be covered by standard insurance, policy subtleties may come into play: like ensuring that unspecified valuables’ total value doesn't exceed a certain percentage of the total contents sum; or having to keep a proportion of your collection in a safe.

Insurance may feel like another boring essential that we buy – and hope we never need. Actually, wristwatch insurance is really worth arranging. So make sure that, whether it’s a high street insurer or specialist watch insurer, you’re covered.

Know your watches’ value too. You can probably check the replacement cost of newer watches online. But what if they’re discontinued, as happened recently with Seiko’s SARB series? Or if you own obscure vintage watches? Whether you invest in professional valuation, or check watch ads, knowing their value is essential. According to Russell Jones-Walker, after having watch insurance, regularly valuing your watches is probably the most important thing any watch collector can do.

Now, with our watch insurance in place, and servicing done (or not), let’s go travelling…

Travelling with watches

For many watch lovers, whether adventuring with a Bremont Terra Nova or doing global business wearing a £130k Patek-Phillipe World Time, watches and travelling go together – and watch lovers usually bring several.

‘Never put watches in checked baggage,’ advises Russell. ‘Insurers consider this unattended luggage and theft won’t be covered. ‘Instead, wear them or keep them in your hand luggage. And never leave your bags unattended.’ Even this can’t guarantee security. In the Daily Mail, Antonia Hoyle investigated the safety of passenger belongings during airport security. It’s not reassuring reading, so arrange good insurance and watch luggage closely. Losing a favourite Tissot T-Touch is annoying, but realising that your Officine Panerai Luminor Marina Oro Rosso just disappeared from that security tray is in a completely different pain league.

‘Instead,’ Jones-Walker advises, ‘put watches in your hand luggage well before going through Security so they’re unseen by anyone but the screeners.’

On arrival, use hotels’ main safes for anything seriously valuable. Room safes are okay, but not always as protective as you’d think. Use common sense on beaches or similar places. Jones-Walker: ‘when a client left a £7,000 OMEGA Speedmaster Moonwatch in an unattended bag, which was stolen, insurers only paid a fraction of the replacement cost.’

As at home, wearing watches while travelling mitigates risk. By all means, rock a cheap beater in riskier places, but remember that insurers want to accommodate your lifestyle, not limit it.

Fight watch crime

In the Telegraph Detective Constable Kevin Parley of the Metropolitan Police’s Flying Squad was quoted saying that ‘There has been a huge explosion in watch crime in recent years, much of it due to the fact that there are now many, many more dealers specialising in pre-owned models, but also because of increased brand awareness — for a long time, Rolex was the only name many people recognised.’

Unfortunately, watch crime sometimes extends to aggravated theft – famously highlighted by Bernie Ecclestone in a bleakly-witty ad after being mugged for his Hublot. Jones-Walker’s advice is unhesitating: ‘Hand over the watch, put your safety first, then contact the police. Rolexes are replaceable; your life isn’t.’

Theft from vehicles is trickier because watches in unattended cars are, by definition, unattended. In practice, if your Cartier Santos is stolen from a locked boot, you should be covered. Areas like this highlight the value of an insurance broker, rather than dealing directly with insurers. In some circumstances, your broker may even be able to sway underwriters in your favour...

Modern security marking is cheap and effective. ‘In the UK,’ says Russell, ‘products such as SmartWater are known to criminals. Especially when used with warning signs, they’re strong deterrents. Finally, after reporting any loss to the police, and initiating your lost watch insurance claim, do register stolen watches with the Art Loss Register’s Watch Register.'

Last thoughts on watch insurance

With the interview ending, I ask Russell whether underwriters ever refuse to cover mega-luxury watches. ‘Actually, not,’ he says, ‘but we never touch fakes, which open the door to intentional or unintentional claims abuse.’

Another scenario that puts insurers on alert is where watch values are inconsistent with proposers’ other property insurance. ‘For instance,’ explains Russell, ‘we’d be wary if someone with total home contents of £75k wanted to insure a million-pound Richard Mille. Generally, high-value watch insurance has no upper limit; it’s the relationship between watches’ value and overall valuables-insured that matters. Several Lumley clients routinely wear watches worth more than a Mercedes with £100k of other jewellery...’

So, beyond a few affordable watches and a basic luxury timepiece, the secret is to insure watches through a trusted watch insurance specialist and value them regularly. Then, knowing they’re insured, enjoy them as their manufacturers intended – even while gardening.

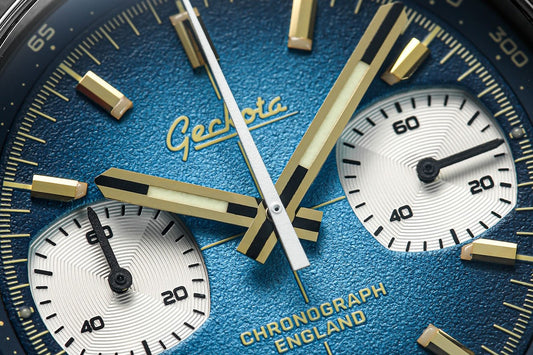

By the way, while Russell Jones-Walker currently enjoys his quartz-powered Fossil, his dream is a rose gold Patek Phillipe Calatrava on brown alligator-style leather. And a couple of Geckota watches have caught his eye too…